Intro

Cross-border payments have long been plagued by inefficiencies, high costs, and delays. Traditional international money transfers involve multiple intermediaries, complex settlement processes, and often take several days to complete. However, the emergence of blockchain technology is poised to revolutionize this landscape, offering transparency, security, and efficiency to cross-border transactions. In this article, we explore how blockchain is reshaping the world of cross-border payments and the benefits it brings to banks, financial institutions, businesses, and individuals.

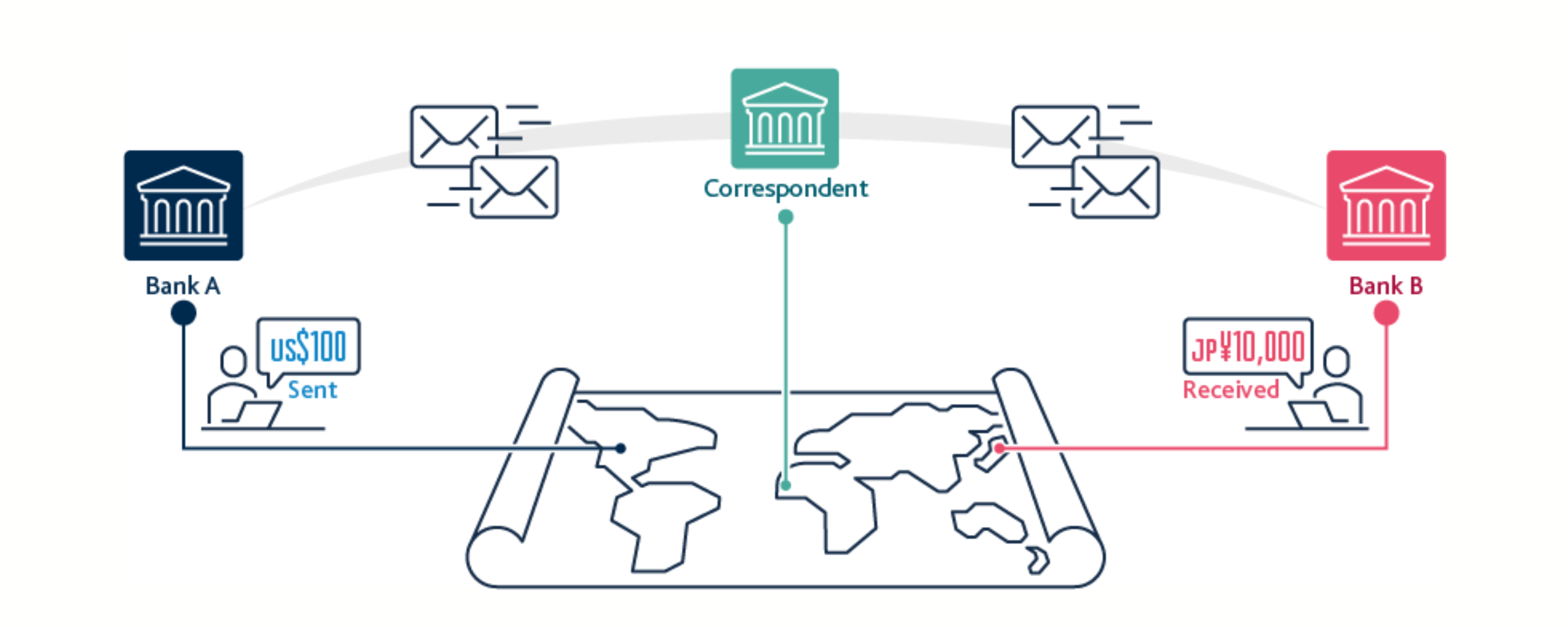

The Current State of Cross-Border Payments:

Traditional cross-border payments face several challenges:

High Costs: Intermediary banks and currency conversion fees can make cross-border transfers expensive.

Delays: International transactions often take days to clear due to the involvement of multiple banks and correspondent relationships.

Lack of Transparency: Tracking the status of cross-border payments can be challenging, leading to uncertainty for both senders and recipients.

Blockchain’s Impact on Cross-Border Payments

Blockchain technology offers several key advantages for cross-border payments:

Instant Settlements: Blockchain enables near-instantaneous settlement of transactions, eliminating the need for multi-day clearing and reducing counterparty risk.

Lower Costs: By cutting out intermediaries and automating processes, blockchain reduces transaction fees, making cross-border payments more cost-effective.

Enhanced Security: Blockchain’s cryptographic features ensure the integrity and confidentiality of transactions, guarding against fraud and unauthorized access.

Transparency and Traceability: Every transaction on a blockchain is recorded in a tamper-proof ledger, providing real-time transparency and traceability for cross-border payments.

Smart Contracts: These self-executing contracts automate payment processes, releasing funds when predefined conditions are met, reducing the need for manual intervention.

Blockchain Implementation Strategies for Cross-Border Payments

To harness the benefits of blockchain for cross-border payments, financial institutions can consider various strategies:

Stablecoins and CBDCs: Issue digital tokens representing national currencies on a blockchain to facilitate instant cross-border transfers.

Integration with Existing Systems: Seamlessly integrate blockchain into the existing payment infrastructure to minimize disruption.

Interbank Settlement: Use blockchain for direct interbank settlements, reducing reliance on correspondent banks.

Smart Contracts: Automate cross-border payment processes with smart contracts to eliminate delays and manual errors.

Compliance and Reporting: Leverage blockchain for efficient compliance with regulatory requirements and streamlined reporting.

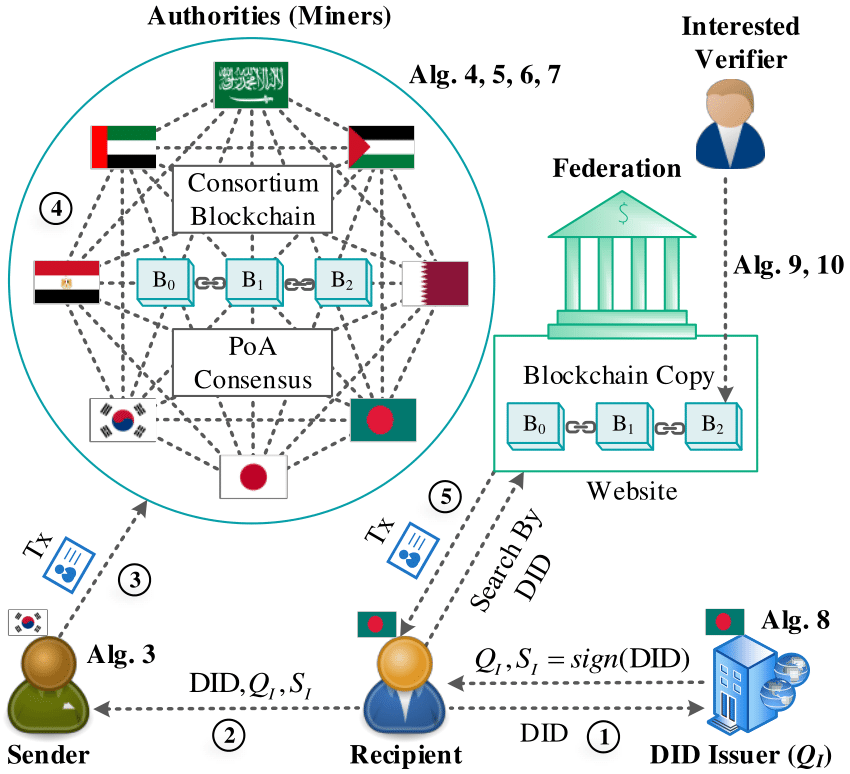

Blockchain Application Architecture for Cross-Border Payments

Designing a blockchain application architecture for cross-border payments requires careful consideration of various components, including the underlying blockchain platform, smart contracts, payment channels, and user interfaces. Choose a blockchain platform that supports smart contracts and is suitable for cross-border payments. Ethereum, Stellar, or a specialized blockchain like Ripple may be appropriate depending on your requirements. Develop smart contracts to automate and manage cross-border payment processes. Smart contracts will handle batching, escrow, and settlement. These contracts can include logic for:

- Batching: Accumulating multiple payment requests into a single transaction to reduce costs.

- Escrow: Holding funds securely until payment conditions are met.

- Settlement: Automatically transferring funds to the recipient when payment conditions are satisfied.

Partner with liquidity providers or integrate with cryptocurrency exchanges to ensure that there are sufficient funds available in various cryptocurrencies to fulfill payment requests. Create a liquidity pool that holds a reserve of cryptocurrencies. This pool can be used to provide liquidity for cross-border payments, ensuring that there are enough assets available for immediate settlement.

Implement a routing algorithm that identifies the most cost-effective way to settle payments using available liquidity. This may involve selecting the optimal payment channels or converting between different cryptocurrencies to meet payment obligations. Integrate with cryptocurrency exchanges or decentralized exchanges (DEXs) to facilitate currency conversion when necessary. Users may initiate payments in one cryptocurrency, but the recipient prefers another.

This architecture combines the benefits of batching to reduce costs and liquidity management to ensure seamless and timely payment processing. It also addresses the complexities of regulatory compliance and security in cross-border payments using blockchain technology. Collaboration with experts in blockchain development and compliance will be essential to successfully implement this architecture.

Challenges and Considerations

While blockchain holds immense promise, challenges must be addressed:

Regulatory Compliance: Ensure adherence to international and local regulations governing cross-border payments and blockchain technology.

Scalability: Choose blockchain platforms that offer scalability to handle high transaction volumes efficiently.

User Education: Educate customers about blockchain-based cross-border payments and provide user-friendly interfaces.

Conclusion

Blockchain technology has the potential to transform cross-border payments, making them faster, more cost-effective, and transparent. Banks, financial institutions, and businesses that embrace this technology stand to benefit from improved efficiency and reduced operational costs. As blockchain continues to mature and regulatory frameworks evolve, it’s increasingly clear that the future of cross-border payments will be built on the foundation of blockchain innovation.