Intro

Asset tokenization has become a transformational force in recent years, altering how we view and use conventional assets. This cutting-edge technology, which is supported by blockchain and smart contracts, has the ability to expand accessibility, release liquidity, and completely transform the landscape of asset ownership and investing. Asset tokenization holds the promise of democratizing investments and creating new pathways for financial inclusion for anything from real estate and fine art to equities and commodities. We will go further into the world of asset tokenization in this extensive post, examining its definition, advantages, difficulties, and potential future.

What is Asset Tokenization?

The act of turning physical assets into digital tokens on a blockchain network is known as asset tokenization. These tokens, also known as security tokens or asset-backed tokens, represent rights to a particular asset or a portion of its ownership. Assets can be separated into more manageable, smaller pieces by tokenization, enhancing accessibility and facilitating transfers.

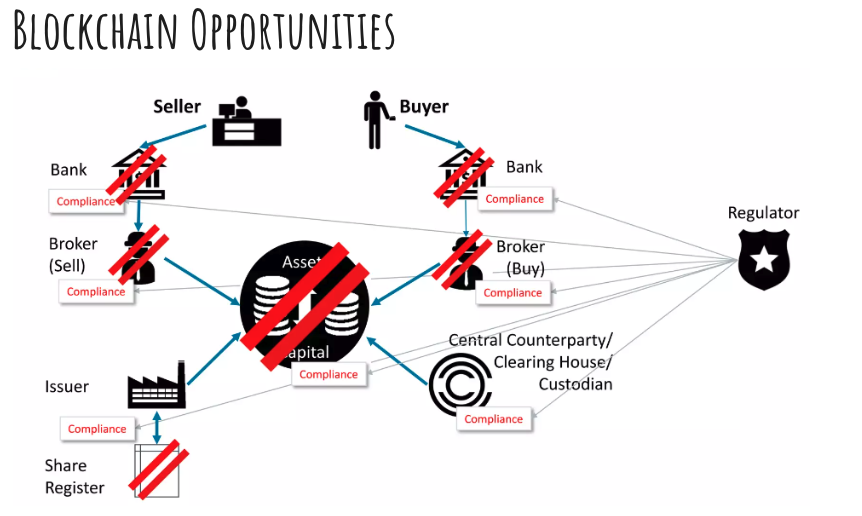

The possibility for enhanced liquidity is one of the key benefits of asset tokenization. Investors can smoothly trade and transfer these tokens on blockchain-based platforms by breaking assets into smaller tokenized units, doing away with the need for middlemen and lowering transactional friction. Prior to this, illiquid assets became liquid, allowing for fractional ownership and increasing investment prospects.

By removing obstacles to entry and opening up formerly exclusive assets to a larger spectrum of investors, asset tokenization democratizes investing. Individuals can invest in high-value assets with less cash required through fractional ownership, creating opportunities for retail investors and advancing financial inclusion.

Asset tokenization provides automation, transparency, and efficiency to formerly manual and opaque processes through the use of blockchain technology and smart contracts. The implementation of terms and conditions, such as dividend distribution and asset transfers, can be automated via smart contracts, cutting down on paper work, administrative expenses, and the chance of human error.

Global trading of tokenized assets is possible across time zones and geographic boundaries. Blockchain networks enable investors from many areas to trade assets and take advantage of investment possibilities, encouraging a more connected and open global market.

Challenges and Considerations

Regulatory Frameworks: Asset tokenization operates in a complex regulatory landscape, varying across jurisdictions. The development of clear and comprehensive regulatory frameworks is essential to ensure compliance, protect investors, and foster market confidence. Governments and regulatory bodies are actively exploring and adapting regulations to accommodate this emerging field.

Europe: MiFID regulations https://www.investopedia.com/terms/m/mifid-ii.asp

US: US not adopted regulations, the Securities Act of 1933 and the Securities Exchange Act of 1934 Comparing EU/US Regulations: https://issuu.com/world.bank.publications/docs/9780821382530

Investor Education: As asset tokenization is a relatively new concept, investor education plays a crucial role in its widespread adoption. Educating investors about the benefits, risks, and mechanics of asset tokenization is essential to build trust, promote responsible investing, and mitigate potential pitfalls.

Security and Trust: While blockchain technology provides inherent security features, ensuring the security and integrity of asset tokenization platforms and infrastructure is paramount. Implementing robust security measures, including encryption, multi-factor authentication, and smart contract auditing, is vital to protect investor funds and prevent fraudulent activities.

Other opportunities

Fractional Ownership of High-Value Assets: Asset tokenization has the potential to unlock fractional ownership of high-value assets, including real estate, luxury goods, and rare collectibles. This will democratize access to these assets, allowing a broader range of investors to participate in their potential appreciation and income streams.

Tokenized Financial Instruments: The tokenization of financial instruments, such as stocks, bonds, and derivatives, is set to revolutionize the traditional financial market. Tokenized securities can streamline processes, reduce intermediaries, enhance transparency